Why Etf Liquidity Matters For Each Investor

Important Risk Information There can be no assurance that a liquid market might be maintained for ETF shares. These desks actively transact within the underlying ETF to dynamically hedge their position(s), as they facilitate transactions on a selection of financial devices for institutional shoppers. Additionally, ETFs seeking to track indices linked to different constructions, such as swaps and futures, are sometimes used in relative worth arbitrage between vehicles. The AP creates/redeems ETF shares by exchanging securities within the basket for shares of ETFs, or vice versa.

- ETFs that put cash into much less liquid securities, similar to real property or assets from emerging markets, tend to have much less liquidity.

- One of the key options of ETFs is that the provision of shares is flexible.

- Moreover, if an ETF invests in illiquid shares or uses leverage, the market price of the ETF could fall dramatically under the fund’s NAV.

- Bid/Ask Spread

- Exchanges give firms looking to market publicly listed securities the platform to do that.

- A narrower unfold regularly signifies higher liquidity and lower buying and selling prices.

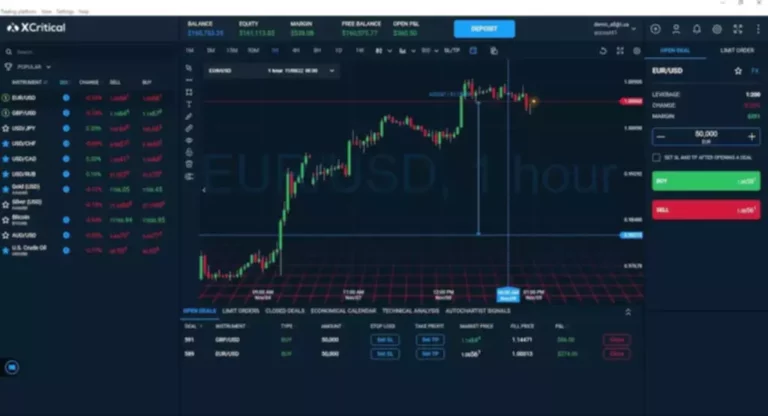

ETF liquidity is among the wide range of companies offered to brokerage corporations. 7 trading instruments, execution from sixty eight milliseconds, spread from $0.01, and a protracted list of different execs. Furthermore, B2Broker has high-end 24/7 support to take away hurdles in a timely method.

Watch Our Partaking Girls Investors—the Intersection Of Eq And Iq Webinar

An ETF is an open-ended fund that gives exposure to underlying funding, normally an index. Like a person stock, an ETF trades on an change throughout the day. Unlike mutual funds, ETFs could be offered brief, purchased on margin and infrequently have choices chains attached to them. Exchange The market where securities, commodities, derivatives and different monetary instruments corresponding to ETFs are traded.

VIX The SPX Volatility Index, also referred to as the VIX or the CBOE Volatility Index, is a measure of the market's expectation of 30-day volatility. It is constructed utilizing the implied volatilities of a variety of S&P 500 index options. That’s why buyers turn to SPDR® ETFs — especially when the VIX trends above its long-term common. Equity securities could fluctuate in worth and might decline considerably in response to the actions of individual companies and common market and economic conditions.

Each of these gamers has a definite position, and their collective actions contribute to the liquidity and total effectivity of the ETF market. Adam Hayes, Ph.D., CFA, is a monetary author with 15+ years Wall Street expertise as a derivatives dealer. Besides his intensive derivative trading experience, Adam is an skilled in economics and behavioral finance. Adam acquired his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder in addition to holding FINRA Series 7, fifty five & 63 licenses. He presently researches and teaches economic sociology and the social research of finance at the Hebrew University in Jerusalem.

How Your Friends Are Positioning Their Portfolios And Related Insights

Authorized individuals which might be unable to buy the parts can not efficiently create ETFs, while illiquid prices of the parts may make redeeming the ETFs much less attractive. After all, liquidity risks have to be discounted in any illiquid security’s valuation because of slippage. Exchange-traded funds have turn out to be extraordinarily popular over the previous twenty years, as investors have sought simpler methods to put money into new markets and asset classes. With over a billion shares per day traded last 12 months, ETFs account for practically one-third of all dollar volume traded on U.S. exchanges. One of the key options of ETFs is that the availability of shares is flexible. In different words, shares can be “created” or “redeemed” to offset changes in demand.

If creations and redemptions are simply facilitated, the actual trading quantity within the ETF might not matter as a lot. Alternatively, even if an ETF has a high buying and selling quantity and a lot of curiosity, however the underlying shares are illiquid, APs may discover engaging in creations and redemptions troublesome. Suppose a firm named GreenTech ETF tracks the clear know-how sector. One day, a breakthrough invention in solar vitality creates waves of excitement in the market. Investors transfer to purchase shares of GreenTech ETF to capitalize on this trend. The sudden surge in demand might drive the share value of the ETF sky-high, deviating from the actual worth of the underlying assets or its NAV.

Liquidity is probably considered one of the most necessary features of exchange-traded funds (ETFs), although incessantly misunderstood. An ETF's liquidity refers to how simply shares can be bought and bought without impacting the ETF's market worth. An ETF's liquidity is essential because it impacts buying and selling prices and helps determine how carefully the ETF's price tracks its underlying assets. Simultaneously making offers ETF liquidity provider to purchase (bid) and sell (ask) securities at specified prices, market makers present two-sided liquidity to different market participants. They facilitate the change of securities between end investors by bridging the hole between the time when natural patrons and sellers enter the market. Market makers revenue from the spreads of their bid/ask quotes, in addition to arbitrage alternatives between an ETF’s NAV and its market value.

This is why it’s essential to make clear and perceive tips on how to decide ETF liquidity. ETFs that invest in less liquid securities, similar to actual property or belongings from emerging markets, are likely to have less liquidity. Many ETFs are open-ended funds, which means they can continuously adapt the variety of excellent shares. Unlike closed-end funds, which have a fixed number of shares, open-ended ETFs can regulate their share rely based on demand and supply dynamics. You need to have the ability to buy and sell securities fast, easily, and at a gorgeous cost.

Investors and traders in any security benefit from greater liquidity—that is, the power to shortly and effectively sell an asset for money. Investors who maintain ETFs that are not liquid might have trouble selling them at the price they want or in the time-frame necessary. Moreover, if an ETF invests in illiquid shares or uses leverage, the market price of the ETF might fall dramatically beneath the fund’s NAV. While trading volume can indicate liquidity, it isn't the whole story. An ETF can have good liquidity even with lower buying and selling volumes because of the creation and redemption mechanisms.

Tips On How To Know If Your Etfs Are Liquid?

This materials is supplied for informational purposes only and is not meant to be investment recommendation or a suggestion to take any explicit funding motion. If an ETF does not trade enough https://www.xcritical.in/, it may not be simple to drag out the investment to convert into cash. This article explains ETF liquidity, how you can measure the liquidity of your ETFs, and why it is important for you.

Liquidity can restrict an investor’s ability to buy and sell without influencing the market worth in an unfavorable way. In common, individual buyers ought to persist with bigger ETFs with excessive buying and selling volumes and tight spreads to reduce their threat, while additionally ensuring that the ETF’s holdings aren’t obscure or illiquid securities. Conversely, authorized individuals can redeem ETF shares in giant increments in change for the underlying securities, or cash, in the acceptable weightings and amounts. ETFs present an arbitrage opportunity and this will ensure even a low AUM ETF maintains a low price-nav difference by way of licensed individuals (AP).

Etf Creation Process

ETF liquidity is predicated on the dynamics in the dealer and secondary markets. Dealers acting as APs can create and redeem ETF shares to fulfill provide and demand adjustments in the ETF and maintain its market value according to its NAV. On the secondary market, ETF shares with larger buying and selling volume and tighter spreads are usually more liquid. Secondary market liquidity, reflected by the bid-ask spread and trading quantity on trading platforms, only indicates the liquidity within the secondary market. However, the entire liquidity of an ETF also contains the first market liquidity that the APs facilitate. The creation and redemption process can significantly enhance an ETF's liquidity beyond what's visible on the screen.

S&p 500 Snapshot: Second Straight Weekly Loss

ETF liquidity is the ease with which an investor can commerce ETFs on the exchange. The liquidity idea of ETFs is multilayered as a end result of ETFs are essentially asset baskets. The greater the liquidity of the underlying asset that comprises an ETF, the better it is to redeem the ETF itself. Newer gamers in the financial markets incessantly misunderstand some essential features, and an ETF is doubtless considered one of the hardest instruments to know.

In essence, the liquidity of the underlying holdings of an ETF instantly impacts the ETF’s liquidity. A well-structured ETF with liquid underlying property can better adapt to market demand modifications, preserving fair prices and an environment friendly investor trading experience. When investors wish to sell their GreenTech ETF shares, a fluid redemption process supported by the liquidity of the underlying holdings helps be positive that the excess provide of ETF shares is effectively absorbed. Conversely, if some or all of the underlying stocks are illiquid—they are onerous to purchase or promote with out considerably affecting the price—the APs may face challenges in assembling or disassembling the baskets shortly. This delay might affect the timeliness and effectivity of the creation and redemption course of, affecting the liquidity of the GreenTech ETF.

The data offered doesn't constitute investment recommendation and it shouldn't be relied on as such. It shouldn't be thought of a solicitation to buy or a proposal to promote a security. It does not keep in mind any investor's explicit funding aims, strategies, tax status or funding horizon.

Net Asset Value (NAV) The value of a share decided by the total value of the securities within the underlying portfolio, much less any liabilities. This material is provided for general informational purposes solely and is not intended to offer authorized, tax, or funding recommendation. Higher spread indicates low liquidity, whereas the tight gap within the spread means larger liquidity. In phrases of belongings, product releases, and adoption by institutional and high-net-worth traders, the Indian ETF sector has expanded and matured significantly over the past ~18 years.

ETF creation and redemption is aided by tapping into the liquidity of an ETF’s underlying portfolio of securities. The purpose of these transactions is to create liquidity within the primary market and make positive that the ETF’s worth very closely reflects the price of its underlying assets (via arbitrage opportunities). For instance, if the worth of an ETF became cheaper than the sum of its parts, the licensed participant may redeem the ETF and promote the parts at a profit. Low levels of liquidity in this market may create premiums and discounts to the ETF’s net asset worth. Short sellers provide liquidity, as they are usually selling into demand when share costs appreciate, and conversely seeking to buy back shares when prices decline.